Both Nifty and Bank Nifty show weakness around critical breakout levels. Despite a global rally, Indian markets failed to keep pace due to domestic challenges.

Can we see new lows? In this bearish phase, traders might consider defensive option strategies like bear spreads or protective puts. Staying hedged and focusing on quality stocks can help manage risk in the volatile landscape.

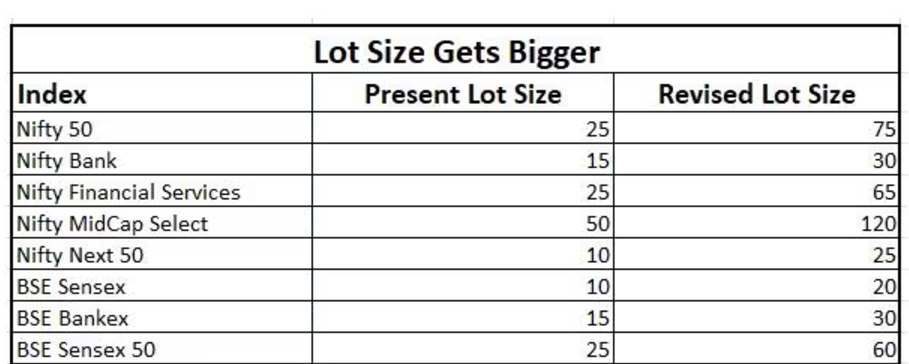

Sebi had revised the minimum contract value to Rs 15 Lakh as against currently Rs 5 – Rs 10 Lakhs for all new index F&O contracts introduced from November 21, 2024. All existing weekly and monthly contracts will continue with the current lot sizes until they expire.

Learn to be a Pro-trader with https://www.OptionGurukul.com/blog/

Build Wealth efficiently by joining Alfinia Millionaires Club as a Wise Investor with https://www.Alfinia.com

India Financial Journey 2047: https://alfinia.com/2024/11/11/indias-financial-journey-to-2047-insights-from-the-cpai-convention-2024/

Share questions and comments below, OR write to gurukuloption@gmail.com